I wrote this for anyone curious to learn about Bitcoin. You don’t need any prior knowledge, although I recommend keeping an open mind and not jumping to conclusions.

12/4/24. For the first time, the BTC/USD exchange rate surpassed $100,000. ‘No-coiners,’ the vast majority of people who don’t own Bitcoin, awoke to the news, some feeling ‘FOMO‘ and others just thinking, “I missed it.” History doesn’t repeat, it rhythms; people have had this exact same reaction at 100, 1,000 and 10,000-dollar Bitcoin. With $100,000 Bitcoin making headlines and trending across social media, I’ve received dozens of messages all asking the same general question, “Is now a good time to buy crypto?”

Every time I get one of these messages I stop what I’m doing and write a lengthy, heartfelt response. Why? Because Bitcoin is a revolutionary, once-in-a-species discovery that can change your life and change the world for the better. I can’t imagine a better use of my time than to share a few lessons I’ve learned along with some words of encouragement.

Let’s start there. The fact that you are reading this and curious about Bitcoin means you are actively working towards a better future for yourself and the people around you. You could be scrolling Tik Tok or watching Netflix but you chose to read this article to actually LEARN something. Respect.

BITCOIN, NOT CRYPTO

Now, back to answering the question, “Is now a good time to buy crypto?” The first point to make is the distinction between Bitcoin and ‘crypto.’ Often the two get conflated and used interchangeably, which confuses folks. If you paid attention in geometry class you know that a square is always a rectangle, but a rectangle is not always a square. Bitcoin is a cryptocurrency but cryptocurrencies are not the same as Bitcoin. Bitcoin is decentralized, finitely scarce and backed by real-world energy (proof of work). My conclusion (after more than 3 years of study) is that every crypto project other than Bitcoin is snake oil. Ethereum, Solana, XRP, Dogecoin, all of it… there is no second best crypto asset. Stable-coins are their own category and have clearly found product-market fit, as well as a warm embrace from regulators/U.S. gov.

The ‘crypto crowd’ will tell you that Bitcoin is slow, doesn’t scale, isn’t private enough, etc. It’s up to you to verify to what extent these claims are true, if at all. In my view, whatever the market demands in relation to money and financial services will be built on top of Bitcoin. For example, Layer 2 technologies such as the Lightning Network aim to solve high fees/slow transaction speeds through what is in effect a “side-chain.” Lightning executes transactions on a separate network rather than use Bitcoin’s Base Chain, aka ‘Layer 1.’ Mathematically, Layer 1 never had the potential to scale to a global payments network due to the limitation of block space and frequency; approximately every 10 minutes a new block is mined, which contains up to about 4MB of data. That’s less than one high resolution photo, for the entire world to share. The point is, Bitcoin scales through layers built ON TOP of the Base Chain rather than by adding more functionality to it. This understanding is core to how Bitcoin and crypto differ.

4 Pieces of Non-Financial Advice

I’m not a financial advisor. Actually, I think financial advisors are unnecessary if not completely obsolete. 95% of fund managers underperform against their benchmarks and have been decimated in comparison to simply buying and holding Bitcoin. Managing finances on your own can be intimidating, but what other choice do you have? The average person spends more than 90,000 hours working in their lifetime… for what? For money. So doesn’t it make sense to spend 50 or 100 hours learning how to preserve and protect all of that hard work? The dollar is a melting ice cube losing value due to new currency issuance every day.

Here are 4 considerations around whether or not to acquire some Bitcoin. Note: you do not need to buy a full Bitcoin. Bitcoin is divided into 100,000,000 sub-units called Satoshis (Sats). At $100k/Bitcoin $1 = 1000 Sats.

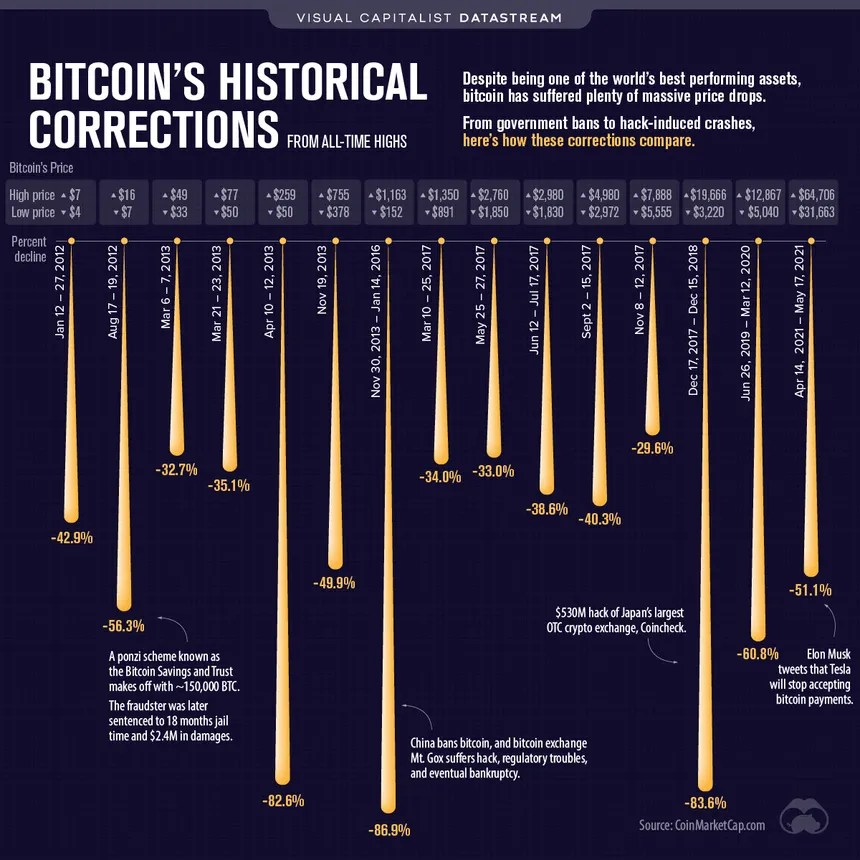

1. There has never been a better time to buy Bitcoin. If you bought Bitcoin in 2011, 2016, or even 2020 you would have been taking much more risk than you are today, in 2024. Sure, knowing Bitcoin’s current price, it’s obvious you should have put your life savings into Bitcoin when it was 8 cents or 8 dollars. But hindsight is 20/20 and you can’t change the past. The three words, “I should have” don’t hold any weight in determining what moves to make going forward. Even if you held Bitcoin during those early years, the path to $100k has not been linear. You would have experienced several 75%+ corrections and the potential end to Bitcoin altogether during the block size wars. You likely would have lost coins or sold them at various all-time highs. Give yourself some grace and recognize that you still have an incredible opportunity in front of you, should you choose to pursue it.

Today, Bitcoin is more legitimized than ever before. Even at all-time highs, the risk in buying Bitcoin is lower because of the problems it solves, its technical properties, and progressing adoption. Large institutions are entering the market, corporations are adopting Bitcoin treasury strategies and nation states are grappling with Bitcoin’s strategic importance. Only the most bullish Bitcoiners could have imagined this level of traction in 2024. Despite all of this, Bitcoin’s market cap is still only $2 trillion in a global asset landscape of $900 trillion. There is less risk and more traction than ever before, making today arguably the best time ever to buy Bitcoin.

2. Ditch the unit bias and think in terms of market cap and Total Addressable Market (TAM) vs. BTC price. $100,000 is big number, even for a millionaire. Many people make the mistake of not investigating Bitcoin further based on this single piece of information. Bitcoin isn’t like a stock, which can be arbitrarily split when the unit price becomes subjectively too high. CFO’s understand human psychology, which is why many companies execute stock splits to keep their share price down. When a company decides to split their stock the valuation doesn’t change, but the number you see on your screen does. Bitcoin doesn’t have an executive team to arbitrarily change what a ‘share’ of Bitcoin costs.

Once you begin to assess value in terms of market cap and TAM, the question becomes, what is Bitcoin’s full potential valuation? Stanford MBA Jesse Myers wrote an article exploring this question. Michael Saylor also created a model which you can use to predict the potential future price of Bitcoin. Van Eck has its own model which predicts $180,000 in 2025 and a $3M price by 2050. Unchained also has a retirement calculator to help plan for the uncertain future. Bitcoin competes in the market for VALUE ITSELF. With conservative assumptions, Bitcoin could become a $100T asset in the next two decades. That would mean the price of one Bitcoin would be about $5M USD and a tenth of a Bitcoin would cost $500k. And yet, at $100,000 per Bitcoin most people think the ship has sailed.

3. Your education should match your allocation. Bitcoin’s high volatility means educating yourself and building conviction around its long-term value appreciation is critical to holding, or “hodling” through the bull and bear markets (note: nation-state adoption could break all of Bitcoin’s historical patterns). I’ve heard the perspective, “If I’m going to invest in Bitcoin I want it to have a material potential impact on my life.” This all or nothing mindset is short-term thinking, ignoring the power of accumulating Bitcoin slowly, over time. The antidote here is to get some skin in the game without over extending yourself. GET OFF ZERO. Buying $100 of Bitcoin may not have a “substantial” impact on your life even when Bitcoin’s price rises to $500k or $1M, but it will create an incentive to learn more.

If your education matches your allocation you can answer the following question yourself: “How much Bitcoin should I own?” Constructing your portfolio via percentage allocation rather than dollar amounts removes the emotion of financial management. With limited education it may make sense to have a 1%, 2% or 5% allocation. Worst case you buy at the cycle peak, Bitcoin corrects by 50% or 75% and you see a temporary decrease in your portfolio’s (dollar-denominated) value. In my experience, learning is the key to growing your Bitcoin stack because you will naturally feel more comfortable increasing your allocation with more knowledge. The only way to lose money in Bitcoin is by selling at a loss or using leverage. With strong conviction around Bitcoin’s long-term value, “dips” become buying opportunities. Lastly, nobody who has held Bitcoin for at least 4 years has lost money.

4. Time in the market beats timing the market. The biggest mistake I made in the last bull market was thinking I could “time the market” by moving in and out of crypto positions. The result? I ended up with less Bitcoin and more taxes than if I had simply bought and held Bitcoin. There are certainly people out there who trade successfully, but they spend a lot of time and attention doing it. I’ve learned to place a high premium on peace of mind, and to prioritize getting more Bitcoin over getting more dollars. Trying to compete with professional traders is like trying to win the World Series of Poker while you’re still learning the rules. The key here is to play the long game, gauging success in 4+ years. Let’s say you buy some Bitcoin today and the price either goes up or down 30% in the coming weeks. If it goes down, you’ll kick yourself for not “waiting for the dip.” If it goes up, you’ll regret not buying more earlier. When in doubt, ZOOM OUT. By taking a long-term approach you can avoid losing peace of mind, which deters you from learning more.

Just like the best diet is the one that is sustainable for you, the stacking strategy you use needs to be sustainable too. If you’ve ever tried to make a positive habit change you know that slow, incremental adjustments lead to better results than drastic changes. You don’t need to sell everything you own and buy Bitcoin today. One common strategy is to DCA (dollar-cost average), diminishing exposure to Bitcoin’s volatility. Here’s a DCA tool that calculates what your returns would have been had you been dollar-cost averaging any given amount over a specific period of time.

After all this commentary you might be wondering, “How do I actually acquire Bitcoin?” For U.S. residents, the easiest and best place I know of is River (I have no affiliation with them). With proof of reserves, River is the most transparent Bitcoin-only exchange I’m aware of. Bitcoin Well is a highly-reputable, non-custodial exchange that forces self-custody from day one. “Not your keys, not your coins” is a phrase you will hear repeatedly as you learn more about Bitcoin. If you don’t personally hold your Bitcoin private keys you don’t actually own Bitcoin. You simply have an IOU from someone else you are trusting to hold your Bitcoin. For more on self-custody I recorded a podcast with Bitcoin Educator, Gabe at the Bitcoin Hardware Store in El Zonte, El Salvador.

The other tool I use is the Fold Card. Fold created a debit card that you fund with dollars to buy gift cards, pay bills, and pay off credit cards. It’s a no-brainer because you don’t need to change your spending habits at all. I recommend Fold to all my friends and family. What I like most about the Fold Card is that it integrates Bitcoin into your life vs. only using it as a long-term store of value. The downside with Fold and River (or any regulated exchange) is that you must disclose personal information to access their platforms. This is due to the Bank Secrecy Act (BSA) and KYC/AML laws.

Conclusion

Education is the foundation of your bitcoin journey. The virtuous cycle of stacking starts with getting off zero, then requires active learning before you can sustainably “hodl” your Bitcoin. My four pieces of non-financial advice:

- Now is the best time to buy Bitcoin.

- Ditch the Unit Bias

- Education Should Match Allocation

- Time in the Market Beats Timing the Market

Bitcoin stores your energy and work through time. If you save in dollars, goods and services get more expensive. If you save in Bitcoin, life gets cheaper as your purchasing power increases. By considering Bitcoin as savings vs. an investment you avoid the “I’m too late” negativity and can get back to what matters- building skills, adding value to the market and living your life. At the end of the day, Bitcoin is just better money.

Resources

Books I’m currently reading:

The Secrets of the Federal Reserve: this book goes deep and describes how various banking families hijacked the United States with the founding of the Federal Reserve. One of the best books in identifying and calling out by name the various actors and culprits of the fiat banking era.

The Dao of Bitcoin by Scott Dedels explores the intersection of Daoist philosophy and Bitcoin, highlighting how the principles of balance and natural order can be applied to the world of cryptocurrency. The book delves into the concept of Bitcoin as “energy money” and its potential to create a more harmonious and interconnected financial system.

My Favorite Bitcoin Podcasts

Bitcoin Audible: Host Guy Swann (the guy who has read more about Bitcoin than anyone else you know) reads a variety of Bitcoin articles and offers commentary throughout. Three years ago Bitcoin Audible was the show that “orange-pilled” me, waking me up to Bitcoin’s elegance and beauty.

Once Bitten: a Bitcoin podcast hosted by Daniel Prince that delves into real-life stories of how Bitcoin has transformed individuals and families. Daniel explores many rabbit holes and doesn’t bother with click-bait, focusing on quality content over anything else.

TFTC: Marty Bent is an OG Bitcoin Podcaster and VC with a balanced and broad perspective. The show features guests who don’t hold back and don’t shy away from the truth. His episodes are always educational and entertaining.

Coin Stories: Natalie Brunell is a journalist turned Bitcoiner who does a fantastic job asking questions and creating concise episodes packed with good information on a weekly basis. She also writes a newsletter that you can find in the podcast notes/description.

The Bitcoin Layer: Nik Bhatia is a USC professor who teaches Bitcoin and macro economics. With a 10+ year background in bond trading and financial markets Nik brings credibility most Bitcoin podcasts simply don’t have. I listen to almost every episode of this show because it keeps me informed on Bitcoin and Macroeconomics.

What is Money?: Ex-Wall Street CFO Robert Breedlove asks the most important question of our time to a broad array of guests. Heavy on the philosophical and deeper nature of Bitcoin, this is another top-notch podcast I listen to regularly. The first 9 episodes with Michael Saylor are a great place to start your Bitcoin journey.

Articles

Bitcoin is Not a Hedge, Parker Lewis

7 Reasons You Are Not Too Late to Bitcoin, Written by Yours Truly

Bitcoin’s Full Potential Valuation, Jesse Myers

Links to Support My Work and Get Involved

We Are Satoshi on YouTube: https://www.youtube.com/@WeAreSatoshiPod

We Are Satoshi on Fountain: https://fountain.fm/show/oNj9eSXpNudLR2XoMtKL

Buy Bitcoin with River: https://river.com/signup?r=4JAPK6Q2

Integrate Bitcoin Into Your Life with Fold: https://use.foldapp.com/r/HU3JEYKH

Great article Kyle!

Elizabeth Huber

emhuber@hotmail.com

206-910-8317

LikeLike