🚀 10x growth for We Are Satoshi this year — fueled by community support 🚀

This year has been huge for the We Are Satoshi podcast. We grew more than 10x and it’s all thanks to the people who support, share, and engage with the content.

Beyond listeners and subscribers, the biggest metric I look at when evaluating the growth of the show is qualitative, through DMs and personal messages. When someone tells me a conversation resonated or they got value from the show more fuel gets added to the fire.

I began this journey with the inclination that I wanted to have conversations about bitcoin and life. Satoshi created bitcoin so we can bring our gifts to the world. 44 episodes in and we’re just getting started.

Going into 2026 I’ve thought a lot about how to monetize the podcast and make it more economically sustainable. Other than doubling down on Nostr and V4V through apps like Fountain.fm, the best way I came up with is through partnering with companies and brands I already use and benefit from. By purchasing through my affiliate links the podcast earns a small commission and you (usually) get a discount on a great product.

To see the list of products on my new “shop” page click here: https://kylehuber.com/shop/

Thank you for the support and if you have any guest recommendations for the podcast in 2026, reach out!

We Are All Born Creative | My Adopting Bitcoin 2025 Presentation

After we learn about bitcoin- we listen to enough podcasts and read enough books- the question becomes, “How can I do more to allocate my time and energy into this new system?” In this talk (Adopting Bitcoin 2025 in El Salvador) I share a few lessons and themes I’ve found in my own quest to answer this question.

For most of my life, I didn’t think of myself as “creative.” Raised in the fiat system, I came out of school believing creativity was reserved for artists. I was the business-minded, logical, pragmatic type — or so I thought. What I didn’t understand then was that creativity is an inherent part of being human.

After college, I picked up a camera with the dream of making documentary films. But that chapter didn’t last long. I had a few rough experiences in the film industry and figured trading time for money was never going to lead to the life I want. I gave up on filmmaking.

Fast forward and bitcoin brought me back towards creating, podcasting and filmmaking. I am currently making a documentary film, Build on Bitcoin, documenting Bulgaria’s grassroots Bitcoin communities in the world. What I experienced there completely transformed how I think about bitcoin adoption. I traveled the country meeting the people building on bitcoin: a guy building a DIY lightning ATM for his local café, a couple writing a children’s book about inflation, a teacher using robotics to subtly introduce Bitcoin ideas to kids, and farmers mining with excess solar because the grid doesn’t support their needs.

None of them waited for permission. None of them worried about scale. They simply saw a problem, applied their creativity, and built something meaningful. This is what permissionless work looks like in the real world — and it’s what the future of Bitcoin actually depends on.

The more time I spend with these builders, the more I see the connection between creativity and freedom. Fiat suppresses creativity by design. It pushes us toward predictable paths, standardized thinking, and safe careers. Bitcoin gives us back the sovereignty to choose how we spend our time and energy. But with that sovereignty comes responsibility.

And that’s where creativity comes in. Creativity to design your life intentionally, turning vision into action. It’s about building something that didn’t exist before — whether that’s a film, a business, a meetup, or simply a better version of yourself.

Bitcoin doesn’t need spectators. It needs contributors. If you feel that pull toward building something, trust it. Follow it. You don’t need permission, you just need to do the proof of work.

Full presentation:

WE ARE ALL SATOSHI!

When the Banks Closed Overnight — and What It Means for the Rest of Us

Subscribe to continue reading

Subscribe to get access to the rest of this post and other subscriber-only content.

Learning Bitcoin: Insights from Experts, Builders & Businesses

This past weekend I had the chance to spend some time just north of me in Vancouver, BC for the Learning Bitcoin 2025 conference. If there’s one thing that has cemented my conviction around Bitcoin, it’s meeting and connecting with people in real life—and this event was overflowing with that energy. I stitched together seven conversations with builders, educators, and entrepreneurs who are working every day to move Bitcoin forward.

Coffee, Connection, and Bitcoin in Vancouver

The first story that really hit home was from Funk Coffee Bar Founder Kurtis, a brewery-turned-café that reinvented itself into a Bitcoin hub. They host meetups and have made it their mission to provide a “third space” for Bitcoiners. Kurtis shared how inflation, lockdowns, and small business struggles galvanized his conviction in Bitcoin—and how the café now sells connection as much as coffee. They’re planning to expand across North America, fueled by both beans and sats.

My First Bitcoin: Education as a Movement

Next up was Quentin from My First Bitcoin, originally born in El Salvador and now a global educational force. Their open-source Bitcoin Diploma curriculum is used by projects in more than 35 countries, and it’s empowering teachers worldwide to teach financial sovereignty in their communities. Their focus is simple: if Bitcoin is going to succeed, education has to come first. Otherwise, it risks capture and dilution. Their resources are free, accessible, and community-driven.

Seb Bunny and the Hidden Cost of Money

One of the highlights of the weekend was meeting the man who inspired the We Are Satoshi podcast, Seb Bunny—the author of The Hidden Cost of Money. He writes about how most of society’s issues are downstream of broken money. Politics, business, relationships, even the environment—they all bend under the weight of monetary corruption. Bitcoin, he argues, is a chance to fix that. But he was quick to add one thing Bitcoin doesn’t fix: happiness. That’s an inside job.

Combatting Indoor Living: Chroma

I also spoke with Brett and Andrew from Chroma, a company tackling another overlooked problem: our light environment. From red-light therapy devices to blue-blocking glasses, they’re creating tools that protect circadian rhythm and mitochondrial health. Chroma connect the dots between Bitcoin and light sovereignty: both are about reclaiming first principles of energy and resisting the systems that seek to capture and control us. If you want to check out their products go to getchroma.co and use the code, KYLE10 for 10% off your order.

Education and Unschooling

Deanna and Joel joined me to talk about their new book, Ownschooling, Bitcoin, Sovereignty and Education. Deanna, a longtime professor turned author, has written both for adults and children—guides that weave together the history of money with the principles of self-directed education. They articulate that just as families should own their financial future with Bitcoin, they should also own their children’s education.

Living on Bitcoin with Coin Cards

From there I spoke with the team at Coin Cards, a company helping Bitcoiners live day-to-day without touching fiat. They let you buy gift cards to major retailers with sats, bridging the gap between savings and spending. Their take? It’s not just about stacking sats and watching number go up—it’s about building an economy around Bitcoin, supporting merchants, and creating use cases that spark curiosity and adoption.

Reflections

Learning Bitcoin 2025 isn’t just a conference—it was an experience of the Bitcoin ethos. Builders, educators, and community leaders all gathering in one place, sharing knowledge, and imagining better ways to live. Whether it was buying a bag of beans with sats, learning about homeschooling, or discussing light health and circadian rhythms, the vibe was generous, hopeful, and grounded.

If you’ve been curious about Bitcoin, I’d encourage you to step into spaces like this. Read a book, join a meetup, or just have a conversation with someone who’s using Bitcoin in their daily life. That human connection changes everything. And if you need a little extra fuel for the journey, make it a light roast. Low time preference coffee for the win.

Check out the video episode here:

⏳ The Clock, Central Banking, and Why We’re Always Out of Time

Your time is finite. Your money isn’t. That mismatch explains why you work harder every year and still feel behind.

Ever wonder why we work 9–5, five days a week, and constantly feel like we don’t have enough time?

In my newest podcast episode, Scott Dedels explains how it comes down to two inventions: the mechanical clock and central banking.

The clock gave us the ability to measure time precisely. That precision enabled factories, schedules, and eventually the 40-hour workweek.

Central banking standardized money, which helped trade and growth. But over the last century, it’s also locked us into a system where money continually loses value.

When you put the two together, here’s what you get:

1. Time is finite. You only have so many hours.

2. Money is infinite (in a fiat system). It can be created endlessly.

That means every hour you trade for money is worth less tomorrow than it is today.

That’s the trap we live in. No matter how much harder you work, you need to work harder again just to keep up.

This is why so many people feel like they’re running out of time. It’s not just the pace of life. It’s structural.

Bitcoin changes this equation. For the first time, you can store your work in a form of money that doesn’t degrade. Your time today holds the same value tomorrow. This simple, yet profound shift opens the door to more freedom, more choice, and more actual time to live.

If you’ve ever felt like the 40-hour grind leaves no room to breathe, this episode is for you.

👉 Listen to “The Time Value of Bitcoin” now.

Full episode on YouTube: https://www.youtube.com/watch?v=YiGfdfr-C-g

Spotify: https://open.spotify.com/episode/0eIPt86FVux5G80wmhVXgW

Apple Podcasts: https://podcasts.apple.com/us/podcast/the-time-value-of-bitcoin-unlocking-optimism-in/id1746234477?

Jeff Booth: Bitcoin’s Success Depends on Action

When I first encountered Jeff Booth’s perspective on Bitcoin, I was struck by the clarity of his conviction: “if Bitcoin doesn’t become a widely used medium of exchange, it will fail.” That statement sets the tone for a deeper discussion about the nature of money, decentralization, and the responsibilities we each hold as participants in this ecosystem.

Jeff’s statement isn’t meant to provoke panic—it’s meant to inspire action. As he explained in our conversation, Bitcoin’s journey mirrors the progression of individual understanding. People first struggle to see it as a store of value. Then, over time, they come to embrace it as such. But even many of those who now “hodl” have trouble imagining Bitcoin as a medium of exchange. Jeff believes this will change as understanding deepens—but only if people use it.

The core issue is this: we’ve never truly lived in a free market. Our monetary systems—gold included—have always been subject to centralization and manipulation. Gold’s failure to become a true medium of exchange made it vulnerable. It was either suppressed through derivative instruments or physically confiscated. Bitcoin, if only stored and never used, faces similar risks. “If you’re just storing Bitcoin, you’re building fragility into the system,” Jeff warned.

That fragility shows up in the reliance on instruments like ETFs or stablecoins. As Jeff put it, “A stablecoin is a guaranteed loss coin against Bitcoin.” These instruments may offer short-term convenience, but they introduce counterparty risk and incentivize centralization—exactly what Bitcoin is designed to resist.

Jeff’s framework for investing through Ego Death Capital builds on these ideas. He and his partners look for founders who are not just chasing profit, but building on Bitcoin’s open, decentralized protocol to create real value. In Jeff’s words, “It’s the first non-zero-sum game the world has ever seen.” In this world, you gain Bitcoin by offering value to others on their terms. That’s the type of system that rewards innovation, not extraction.

Our conversation also dove into what it means to build in a deflationary world. The traditional mindset focuses on fractionalizing assets—slicing everything up to squeeze out more return. But in a Bitcoin-denominated world, prices fall and value creation matters more than financial engineering. Jeff contrasted most of the crypto space with what Bitcoin is really about: building a parallel system that offers freedom, transparency, and abundance.

One of the most compelling parts of our talk was when we touched on cultural contributions to Bitcoin—projects that aren’t necessarily profit-driven, like filmmaking, education, or community-building. Jeff believes a wave of support for cultural initiatives is coming. As wealth accrues in the Bitcoin economy, it will eventually find its way into the arts, into storytelling, into education.

We also talked about Bulgaria, where Jeff had spent time meeting local Bitcoiners. I’ve been lucky to work with some of those same people, including my friend and collaborator Ivan Makedonski. Jeff met Ivan at a Bitcoin event, and what followed was a classic example of permissionless contribution. Ivan just started doing the work—no job offer, no permission. He showed up, stayed in touch, and eventually landed a role at Breeze. His story, rooted in personal tragedy, became a mission to ensure no one else has to suffer from the failures of fiat systems.

Bitcoin is laying the foundation for the world’s first global free market, where the value flows to everyone in the system, not just the top of the hierarchy. As Jeff said, “You win by helping others.” That mindset shift—from scarcity to abundance, from extraction to contribution—is what pulled me back into creativity. Bitcoin gave me permission to pursue storytelling with meaning again.

In the end, our conversation reminded me that we’re not just trying to build new tools. We’re building new norms, new incentives, and new cultures. The question I left with was simple but profound: what can I do today to make this network stronger?

Full episode on YouTube here:

Watch/listen on Spotify here: https://open.spotify.com/episode/12q7toPhMFgZRmcpA3z7zq

Support my work!

Geyser page for Build on Bitcoin, the movie: https://geyser.fund/project/bulgarianjourney

15% off earthy energy, grown-up hot chocolate for CLEAN FOCUSED ENERGY

If you are interested in buying Bitcoin, River is the best place to do so: https://river.com/signup?r=4JAPK6Q2

For Bitcoin rewards and gift cards I use the Fold Card: https://use.foldapp.com/r/HU3JEYKH

Send me an email with feedback/questions: wearesatoshipod@gmail.com

Is Now a Good Time to Buy Crypto?

I wrote this for anyone curious to learn about Bitcoin. You don’t need any prior knowledge, although I recommend keeping an open mind and not jumping to conclusions.

12/4/24. For the first time, the BTC/USD exchange rate surpassed $100,000. ‘No-coiners,’ the vast majority of people who don’t own Bitcoin, awoke to the news, some feeling ‘FOMO‘ and others just thinking, “I missed it.” History doesn’t repeat, it rhythms; people have had this exact same reaction at 100, 1,000 and 10,000-dollar Bitcoin. With $100,000 Bitcoin making headlines and trending across social media, I’ve received dozens of messages all asking the same general question, “Is now a good time to buy crypto?”

Every time I get one of these messages I stop what I’m doing and write a lengthy, heartfelt response. Why? Because Bitcoin is a revolutionary, once-in-a-species discovery that can change your life and change the world for the better. I can’t imagine a better use of my time than to share a few lessons I’ve learned along with some words of encouragement.

Let’s start there. The fact that you are reading this and curious about Bitcoin means you are actively working towards a better future for yourself and the people around you. You could be scrolling Tik Tok or watching Netflix but you chose to read this article to actually LEARN something. Respect.

BITCOIN, NOT CRYPTO

Now, back to answering the question, “Is now a good time to buy crypto?” The first point to make is the distinction between Bitcoin and ‘crypto.’ Often the two get conflated and used interchangeably, which confuses folks. If you paid attention in geometry class you know that a square is always a rectangle, but a rectangle is not always a square. Bitcoin is a cryptocurrency but cryptocurrencies are not the same as Bitcoin. Bitcoin is decentralized, finitely scarce and backed by real-world energy (proof of work). My conclusion (after more than 3 years of study) is that every crypto project other than Bitcoin is snake oil. Ethereum, Solana, XRP, Dogecoin, all of it… there is no second best crypto asset. Stable-coins are their own category and have clearly found product-market fit, as well as a warm embrace from regulators/U.S. gov.

The ‘crypto crowd’ will tell you that Bitcoin is slow, doesn’t scale, isn’t private enough, etc. It’s up to you to verify to what extent these claims are true, if at all. In my view, whatever the market demands in relation to money and financial services will be built on top of Bitcoin. For example, Layer 2 technologies such as the Lightning Network aim to solve high fees/slow transaction speeds through what is in effect a “side-chain.” Lightning executes transactions on a separate network rather than use Bitcoin’s Base Chain, aka ‘Layer 1.’ Mathematically, Layer 1 never had the potential to scale to a global payments network due to the limitation of block space and frequency; approximately every 10 minutes a new block is mined, which contains up to about 4MB of data. That’s less than one high resolution photo, for the entire world to share. The point is, Bitcoin scales through layers built ON TOP of the Base Chain rather than by adding more functionality to it. This understanding is core to how Bitcoin and crypto differ.

4 Pieces of Non-Financial Advice

I’m not a financial advisor. Actually, I think financial advisors are unnecessary if not completely obsolete. 95% of fund managers underperform against their benchmarks and have been decimated in comparison to simply buying and holding Bitcoin. Managing finances on your own can be intimidating, but what other choice do you have? The average person spends more than 90,000 hours working in their lifetime… for what? For money. So doesn’t it make sense to spend 50 or 100 hours learning how to preserve and protect all of that hard work? The dollar is a melting ice cube losing value due to new currency issuance every day.

Here are 4 considerations around whether or not to acquire some Bitcoin. Note: you do not need to buy a full Bitcoin. Bitcoin is divided into 100,000,000 sub-units called Satoshis (Sats). At $100k/Bitcoin $1 = 1000 Sats.

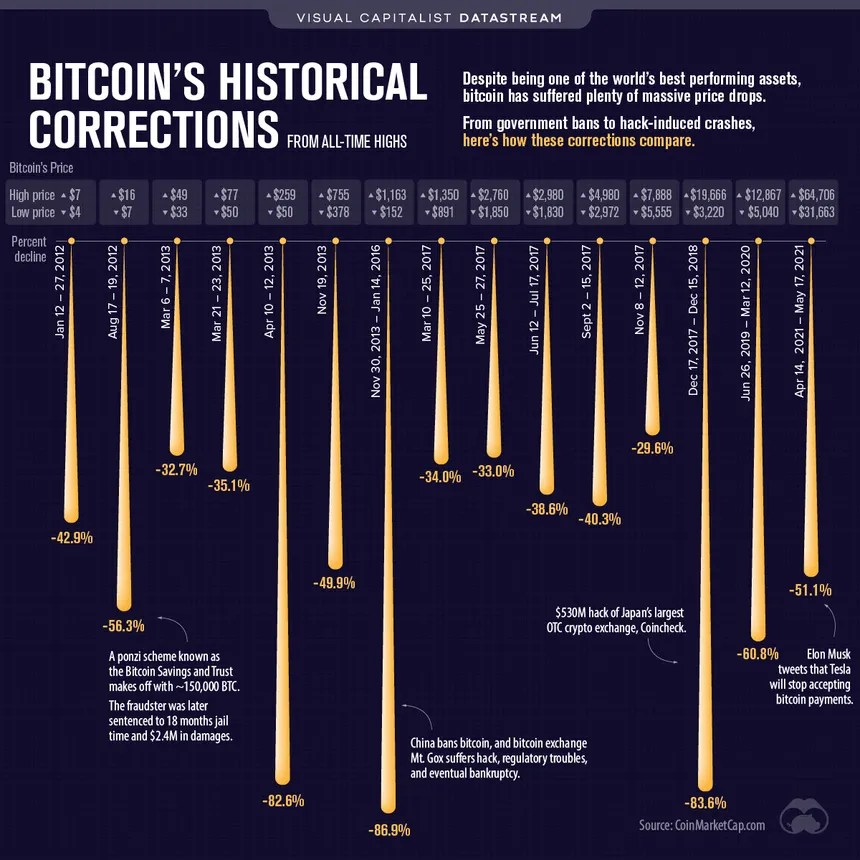

1. There has never been a better time to buy Bitcoin. If you bought Bitcoin in 2011, 2016, or even 2020 you would have been taking much more risk than you are today, in 2024. Sure, knowing Bitcoin’s current price, it’s obvious you should have put your life savings into Bitcoin when it was 8 cents or 8 dollars. But hindsight is 20/20 and you can’t change the past. The three words, “I should have” don’t hold any weight in determining what moves to make going forward. Even if you held Bitcoin during those early years, the path to $100k has not been linear. You would have experienced several 75%+ corrections and the potential end to Bitcoin altogether during the block size wars. You likely would have lost coins or sold them at various all-time highs. Give yourself some grace and recognize that you still have an incredible opportunity in front of you, should you choose to pursue it.

Today, Bitcoin is more legitimized than ever before. Even at all-time highs, the risk in buying Bitcoin is lower because of the problems it solves, its technical properties, and progressing adoption. Large institutions are entering the market, corporations are adopting Bitcoin treasury strategies and nation states are grappling with Bitcoin’s strategic importance. Only the most bullish Bitcoiners could have imagined this level of traction in 2024. Despite all of this, Bitcoin’s market cap is still only $2 trillion in a global asset landscape of $900 trillion. There is less risk and more traction than ever before, making today arguably the best time ever to buy Bitcoin.

2. Ditch the unit bias and think in terms of market cap and Total Addressable Market (TAM) vs. BTC price. $100,000 is big number, even for a millionaire. Many people make the mistake of not investigating Bitcoin further based on this single piece of information. Bitcoin isn’t like a stock, which can be arbitrarily split when the unit price becomes subjectively too high. CFO’s understand human psychology, which is why many companies execute stock splits to keep their share price down. When a company decides to split their stock the valuation doesn’t change, but the number you see on your screen does. Bitcoin doesn’t have an executive team to arbitrarily change what a ‘share’ of Bitcoin costs.

Once you begin to assess value in terms of market cap and TAM, the question becomes, what is Bitcoin’s full potential valuation? Stanford MBA Jesse Myers wrote an article exploring this question. Michael Saylor also created a model which you can use to predict the potential future price of Bitcoin. Van Eck has its own model which predicts $180,000 in 2025 and a $3M price by 2050. Unchained also has a retirement calculator to help plan for the uncertain future. Bitcoin competes in the market for VALUE ITSELF. With conservative assumptions, Bitcoin could become a $100T asset in the next two decades. That would mean the price of one Bitcoin would be about $5M USD and a tenth of a Bitcoin would cost $500k. And yet, at $100,000 per Bitcoin most people think the ship has sailed.

3. Your education should match your allocation. Bitcoin’s high volatility means educating yourself and building conviction around its long-term value appreciation is critical to holding, or “hodling” through the bull and bear markets (note: nation-state adoption could break all of Bitcoin’s historical patterns). I’ve heard the perspective, “If I’m going to invest in Bitcoin I want it to have a material potential impact on my life.” This all or nothing mindset is short-term thinking, ignoring the power of accumulating Bitcoin slowly, over time. The antidote here is to get some skin in the game without over extending yourself. GET OFF ZERO. Buying $100 of Bitcoin may not have a “substantial” impact on your life even when Bitcoin’s price rises to $500k or $1M, but it will create an incentive to learn more.

If your education matches your allocation you can answer the following question yourself: “How much Bitcoin should I own?” Constructing your portfolio via percentage allocation rather than dollar amounts removes the emotion of financial management. With limited education it may make sense to have a 1%, 2% or 5% allocation. Worst case you buy at the cycle peak, Bitcoin corrects by 50% or 75% and you see a temporary decrease in your portfolio’s (dollar-denominated) value. In my experience, learning is the key to growing your Bitcoin stack because you will naturally feel more comfortable increasing your allocation with more knowledge. The only way to lose money in Bitcoin is by selling at a loss or using leverage. With strong conviction around Bitcoin’s long-term value, “dips” become buying opportunities. Lastly, nobody who has held Bitcoin for at least 4 years has lost money.

4. Time in the market beats timing the market. The biggest mistake I made in the last bull market was thinking I could “time the market” by moving in and out of crypto positions. The result? I ended up with less Bitcoin and more taxes than if I had simply bought and held Bitcoin. There are certainly people out there who trade successfully, but they spend a lot of time and attention doing it. I’ve learned to place a high premium on peace of mind, and to prioritize getting more Bitcoin over getting more dollars. Trying to compete with professional traders is like trying to win the World Series of Poker while you’re still learning the rules. The key here is to play the long game, gauging success in 4+ years. Let’s say you buy some Bitcoin today and the price either goes up or down 30% in the coming weeks. If it goes down, you’ll kick yourself for not “waiting for the dip.” If it goes up, you’ll regret not buying more earlier. When in doubt, ZOOM OUT. By taking a long-term approach you can avoid losing peace of mind, which deters you from learning more.

Just like the best diet is the one that is sustainable for you, the stacking strategy you use needs to be sustainable too. If you’ve ever tried to make a positive habit change you know that slow, incremental adjustments lead to better results than drastic changes. You don’t need to sell everything you own and buy Bitcoin today. One common strategy is to DCA (dollar-cost average), diminishing exposure to Bitcoin’s volatility. Here’s a DCA tool that calculates what your returns would have been had you been dollar-cost averaging any given amount over a specific period of time.

After all this commentary you might be wondering, “How do I actually acquire Bitcoin?” For U.S. residents, the easiest and best place I know of is River (I have no affiliation with them). With proof of reserves, River is the most transparent Bitcoin-only exchange I’m aware of. Bitcoin Well is a highly-reputable, non-custodial exchange that forces self-custody from day one. “Not your keys, not your coins” is a phrase you will hear repeatedly as you learn more about Bitcoin. If you don’t personally hold your Bitcoin private keys you don’t actually own Bitcoin. You simply have an IOU from someone else you are trusting to hold your Bitcoin. For more on self-custody I recorded a podcast with Bitcoin Educator, Gabe at the Bitcoin Hardware Store in El Zonte, El Salvador.

The other tool I use is the Fold Card. Fold created a debit card that you fund with dollars to buy gift cards, pay bills, and pay off credit cards. It’s a no-brainer because you don’t need to change your spending habits at all. I recommend Fold to all my friends and family. What I like most about the Fold Card is that it integrates Bitcoin into your life vs. only using it as a long-term store of value. The downside with Fold and River (or any regulated exchange) is that you must disclose personal information to access their platforms. This is due to the Bank Secrecy Act (BSA) and KYC/AML laws.

Conclusion

Education is the foundation of your bitcoin journey. The virtuous cycle of stacking starts with getting off zero, then requires active learning before you can sustainably “hodl” your Bitcoin. My four pieces of non-financial advice:

- Now is the best time to buy Bitcoin.

- Ditch the Unit Bias

- Education Should Match Allocation

- Time in the Market Beats Timing the Market

Bitcoin stores your energy and work through time. If you save in dollars, goods and services get more expensive. If you save in Bitcoin, life gets cheaper as your purchasing power increases. By considering Bitcoin as savings vs. an investment you avoid the “I’m too late” negativity and can get back to what matters- building skills, adding value to the market and living your life. At the end of the day, Bitcoin is just better money.

Resources

Books I’m currently reading:

The Secrets of the Federal Reserve: this book goes deep and describes how various banking families hijacked the United States with the founding of the Federal Reserve. One of the best books in identifying and calling out by name the various actors and culprits of the fiat banking era.

The Dao of Bitcoin by Scott Dedels explores the intersection of Daoist philosophy and Bitcoin, highlighting how the principles of balance and natural order can be applied to the world of cryptocurrency. The book delves into the concept of Bitcoin as “energy money” and its potential to create a more harmonious and interconnected financial system.

My Favorite Bitcoin Podcasts

Bitcoin Audible: Host Guy Swann (the guy who has read more about Bitcoin than anyone else you know) reads a variety of Bitcoin articles and offers commentary throughout. Three years ago Bitcoin Audible was the show that “orange-pilled” me, waking me up to Bitcoin’s elegance and beauty.

Once Bitten: a Bitcoin podcast hosted by Daniel Prince that delves into real-life stories of how Bitcoin has transformed individuals and families. Daniel explores many rabbit holes and doesn’t bother with click-bait, focusing on quality content over anything else.

TFTC: Marty Bent is an OG Bitcoin Podcaster and VC with a balanced and broad perspective. The show features guests who don’t hold back and don’t shy away from the truth. His episodes are always educational and entertaining.

Coin Stories: Natalie Brunell is a journalist turned Bitcoiner who does a fantastic job asking questions and creating concise episodes packed with good information on a weekly basis. She also writes a newsletter that you can find in the podcast notes/description.

The Bitcoin Layer: Nik Bhatia is a USC professor who teaches Bitcoin and macro economics. With a 10+ year background in bond trading and financial markets Nik brings credibility most Bitcoin podcasts simply don’t have. I listen to almost every episode of this show because it keeps me informed on Bitcoin and Macroeconomics.

What is Money?: Ex-Wall Street CFO Robert Breedlove asks the most important question of our time to a broad array of guests. Heavy on the philosophical and deeper nature of Bitcoin, this is another top-notch podcast I listen to regularly. The first 9 episodes with Michael Saylor are a great place to start your Bitcoin journey.

Articles

Bitcoin is Not a Hedge, Parker Lewis

7 Reasons You Are Not Too Late to Bitcoin, Written by Yours Truly

Bitcoin’s Full Potential Valuation, Jesse Myers

Links to Support My Work and Get Involved

We Are Satoshi on YouTube: https://www.youtube.com/@WeAreSatoshiPod

We Are Satoshi on Fountain: https://fountain.fm/show/oNj9eSXpNudLR2XoMtKL

Buy Bitcoin with River: https://river.com/signup?r=4JAPK6Q2

Integrate Bitcoin Into Your Life with Fold: https://use.foldapp.com/r/HU3JEYKH

7 Reasons Why You’re Not Too Late to Bitcoin

The Logic Behind “I’m Too Late to Bitcoin”

It makes sense why someone who hasn’t researched Bitcoin would assume that they are too late to the game. Bitcoin’s first known transaction took place on May 22nd, 2010, when Laszlo Hanyecz, a programmer, offered 10,000 Bitcoins (approximately $41 at the time) to anyone who could obtain two large Papa John’s pizzas and deliver them to his doorstep. Laszlo established Bitcoin’s first price, less than half a cent. Since then, Bitcoin has faced relentless attacks from nation states, banks, sophisticated hackers, and subject to endless slander from the media… all while growing to a market cap of $1.5 trillion.

From $0.0041 to $65,000 is a 15-million bagger. Due to the law of large numbers, you’re not likely to see another 15,000,000x return without severe hyperinflation; but the question at hand is not whether you’re too late to get insanely rich off a tiny investment in a short period of time. The question is, are you too late to dramatically improve your and your loved ones’ lives with Bitcoin? The answer is unequivocally, NO.

Disclaimer: Bitcoin is a disruptive technology laying the foundation for an entirely new economic system. It should be noted, as Jeff Booth, author of The Price of Tomorrow says, “anything that attempts to value the new system in terms of the old system is fundamentally flawed.” Thinking about Bitcoin in terms of dollars has a number of pitfalls, including that it makes Bitcoin seem volatile. In reality, 1 BTC = 1 BTC. Nonetheless, number-go-up does more marketing for Bitcoin than anything else, which is why it’s useful to this discussion. This is evidenced by the following chart of retail adoption vs. price. As price rises, new buyers enter the market. When price falls, they exit.

Bitcoin has seen multiple 75%+ corrections, including a 35% correction this year. Without strong conviction around Bitcoin’s long-term value, these draw-downs tend to shake Bitcoin holders out and discourage them from returning. However, even during the worst performing four year period in Bitcoin’s history (December 2017-2021), you would still have seen a 23% CAGR. Lowering your time preference is key to weathering Bitcoin’s short-term price volatility. When in doubt, zoom out.

Reason 1: Money is a Technology and Bitcoin is Better Money

Money is an emergent technology that solves the Double Coincidence of Wants Problem. People have used beads, shells, large rocks and cacao beans as money, but there have only been two layer one monies adopted globally: gold and dollars. Gold was a widely accepted form of money for 5,000 years because it outperformed the alternatives in terms of its durability, portability and divisibility. Gold backed the US Dollar until 1971… how the dollar became unpegged from gold is a discussion for another day. The point is, dollars (paper IOUs) were easier to move, divide and trade, which is largely why gold failed. Bitcoin is more durable, portable and divisible than both gold and dollars which is part of makes it the best money ever discovered.

For more on how Bitcoin obsoletes all other monies, here are a few books to read:

- The Bitcoin Standard by Saifadean Ammous

- Gradually, Then Suddenly by Parker Lewis

- Broken Money by Lyn Alden

- The Hidden Cost of Money by Seb Bunney

Reason 2: Inflation Protection

Beyond the three aforementioned properties, money’s most important function is storing purchasing power through time. When demand for gold increases, gold production increases. When demand for dollars increases (i.e. the government wants to finance a war or manipulate the economy), the bankers and politicians simply create more, diluting the value of the current dollars in circulation. While it is difficult to say exactly how much purchasing power the dollar has lost over a specific time frame, I don’t need to convince you that the prices of food, gas, rent, etc. have increased dramatically in recent years.

Keynesian economists assert that 2% inflation is healthy and the “velocity” of money helps to “grease the economic wheels.” This is a fallacy with profound implications. A 2% annual inflation rate halves the value of money in approximately 36 years. As a result, the average person must become an investor in their free time, using assets like stocks and real estate to protect themselves from debasement. But not everyone has the ability to invest in stocks, or purchase real estate. Currency debasement increases the wealth gap between people who save in hard assets and people who save in cash. Bitcoin is more accessible and scarce than stocks or real estate, making it a superior store of value. The following chart shows the relationship between the monetary base and inflation.

Reason 3: Increased Purchasing Power Over Time

Historical data indicates that Bitcoin is likely to buy more goods and services in the future than it does today. While this is not an investment pitch, Bitcoin’s dollar price does more marketing than anything else.

Try this exercise- consider the three most valuable assets you own. Your car, house, computer, maybe a private jet? How much did they cost at the time in terms of dollars and in terms of Bitcoin? How much would it cost for you to purchase that same asset today in terms of dollars? What about in terms of Bitcoin?

This chart shows the price of an average home in terms of the two competing monies, highlighting Bitcoin’s increasing purchasing power vs. the dollar’s erosion of value. Over a 4+ year time frame, it’s almost guaranteed that these three assets would cost less Bitcoin today, and more dollars (Anthony Pompliano explains this in relation to the median home). The key insight here is that Bitcoin is already re-pricing all assets. As long as Bitcoin remains decentralized and secure, this trend is likely to continue. The counter argument here is that the same could be said about gold or stocks. Gold already failed as money and you can’t buy anything with stocks. While Bitcoin is not yet a widely accepted medium of exchange, it is already being used to purchase assets such as real estate.

Reason 4: A Growing Network, Lagging Price

Price and market cap are metrics that fail to capture the Bitcoin network‘s overall growth. Bitcoin’s price topped $67k in November 2021 before entering a bear market that bottomed around $16k. As of today (October 2024) the USD/BTC exchange rate is dancing between $60-70k/BTC. Based on this one metric, we could conclude that Bitcoin’s growth has been stagnant for three years. This is an incorrect assessment. While BTC price has not surpassed it’s inflation-adjusted all-time highs in three years, other metrics such as hash rate, difficulty adjustment, active nodes, stock-to-flow, and on-chain analytics tell a different story.

As you can see in the chart above, Bitcoin’s hash rate continues to increase over time. Bitcoin miners are directing more and more energy to the network, making it more robust and secure. Miners have skin in the game, and the fact that hash rate continues to increase is a signal that they expect the network to continue growing. Add to that the number of full Bitcoin nodes, active wallet addresses, increased mining difficulty and supply distribution. These metrics point to Bitcoin’s growth, with price being a lagging indicator.

Reason 5: Supply and Demand: Institutional and Corporate Adoption

Institutions and corporations have opened the floodgates for larger pools of capital to flow into Bitcoin. In 2024, Bitcoin ETFs set record inflows and quickly became top 10 funds in terms of AUM, causing a ruckus on Wall Street. Corporations are adopting Bitcoin as a treasury asset, adding it to their balance sheet instead of holding cash, T-Bills or bonds. MicroStrategy (MSTR) pioneered the Bitcoin treasury playbook, and since August 2020 has outperformed every single company in the S&P 500, including Invidia (NVDA).

The predicament MicroStrategy faced in 2020 is not unique. Companies with cash and cash equivalents on their balance sheets are holding a melting fiat ice cube, losing purchasing power every day. Saylor’s strategy is being replicated by other companies such as Square, Semler Scientific, Fold and others. What happens when Apple or Microsoft decides to put 5% of its treasury into Bitcoin?

Sovereign wealth funds and nation states are also starting to adopt Bitcoin. El Salvador adopted bitcoin as legal tender in 2021 and has been purchasing 1 BTC every day since. Bhutan has been quietly mining Bitcoin for years. Wisconsin’s pension fund now holds Bitcoin. US politicians are discussing Bitcoin as a strategic reserve asset. Rewind just a few years and all of this would sound ludicrous. The Overton window has shifted and Bitcoin is no longer just magic internet money for money laundering and illegal transactions.

These groups are driving demand, but what about supply? Since 2021 the amount of Bitcoin issued to the network halved, from 6.5 BTC/block (~900 BTC/day) to 3.125 BTC/block (450 per day). ~19,570,000 or 93% of Bitcoin have been mined to date, and by 2034, 99% of all Bitcoin ever to exist will be in circulation, or lost. Michael Saylor aptly describes the coming decade as the “Digital Gold Rush.” Bitcoin’s absolute scarcity is something humanity has never experienced before.

Reason 6: Overcoming Unit Bias

Bitcoin’s unit bias causes many people to think they are too late to Bitcoin. From an early age, we are conditioned to think in terms of dollars. At $0.05, $5, $500, or even $5,000, owning a full Bitcoin was feasible on an entry-level salary. But today, only 1 in 3 Americans can afford a $400 emergency expense. Acquiring a full Bitcoin is out of the question, so why even try? What these folks fail to see is that is that mathematically, owning 1 BTC was never going to achievable for the average person. If you divide Bitcoin’s total supply, 21 million, by 8 billion, the current global population, the result is .002625 Bitcoin or 262,500 Satoshis (a Satoshi is 1/100,000,000th of a Bitcoin). However, Bitcoin ownership is not evenly distributed. MicroStrategy currently holds more than 252,000 BTC. Once you account for the 20-30% of coins already lost forever, there’s no way everyone can own 262k sats. At the time of writing, 262k sats is worth ~$170. You read that right. For $170 you can buy more Bitcoin than the average person will ever own. Unlike stocks, Bitcoin does not have CEO who can decide to do a share split to avoid unit bias, which means those who can wrap their head around this are likely to adopt Bitcoin sooner.

Reason 7: Not Just a Store of Value – Bitcoin Use Cases

Bitcoin is versatile. People with differing pain points and needs use Bitcoin in distinct ways. In the West, Bitcoin is typically thought of as a store of value. “Do you invest in Bitcoin?” “At what price will you sell?” In other countries, Bitcoin is useful for different reasons. For example, a Ukrainian refugee was able to escape to Poland with much of his wealth, rather than leave everything he worked for behind. Bitcoin is also being used to get aid to Gaza, and facilitate P2P transactions in Nigeria. Cross-border remittances are another way Bitcoin is giving power back to the people. These use cases are happening all over the world today. Because Bitcoin is a digital bearer asset protected by the strongest cryptographic network ever created, it provides optionality for an uncertain future.

Human Rights Foundation Chief Strategy Officer, Alex Gladstein makes the case that Bitcoin has four primary use cases: savings, commerce, freedom and power. You can listen to his episode on What Bitcoin Did, here. In addition to Alex’s thesis on four primary use cases, Bitcoin researcher Daniel Batten outlines 19 ways bitcoin is already being used. Bitcoin has even more potential because it is not just a store of value.

Conclusion

THERE IS NO SUCH THING AS BEING “TOO LATE” TO BITCOIN. Is it too late to start eating healthy? Is it too late to start working out? Is it too late to start an internet-based business? Of course not. In the same way, it’s never too late to study and ultimately plug Bitcoin into your life. As BTC Sessions articulates, “the last person on earth to adopt Bitcoin will benefit from it immensely.” There’s no arguing that the longer you wait, and the higher Bitcoin’s price goes, the harder it will be to acquire a certain amount of Bitcoin, but even if you don’t adopt it personally, Bitcoin is threatening the power of the money printer and creating more transparency and fairness in the economic system.

You get Bitcoin at the price you deserve. I remember when Bitcoin’s price was $23. I didn’t deserve it then. It took the government sending me a $1400 stimulus check in 2020 to buy my first Bitcoin, and it’s changed my life in many ways since. Bitcoin’s eventual USD-denominated price is already known: infinity / 21M. Bitcoin has no ceiling because fiat has no floor.

In conclusion, I hope this article sparked some curiosity to learn more about how Bitcoin solves the age-old problem of currency debasement. Reach out to me with any feedback or questions: wearesatoshipod@gmail.com. Satoshi Nakamoto created Bitcoin so that you could create the life you are meant to live.

Last thing- the arguments in this article still hold up once Bitcoin’s price surpasses $100k, $1M or $10M. The only thing that would make you too late to Bitcoin is if the network itself is no longer secure or decentralized.

Listen to the episode here: https://open.spotify.com/episode/50RYL1TEMWLK2azBNoLh5s

The Bike Will Set You Free

Riding a bike is like entering another dimension. The limitations of being on foot go away, the laws of physics seem to change, and life’s everyday worries subside. To me, cycling is freedom.

I’ve loved riding bikes since before I can remember. My mom tells a classic story about my brother and I riding trikes down the hallway at 2 and 3 years old, going from full speed to a swift stop and turn without scuffing the walls. In 3rd grade I started riding to school, and the bike gave me a new level of autonomy. Living on a small island, I could ride almost anywhere I wanted to go. In my early 20s, I discovered the full suspension carbon mountain bike, and more recently, decided to give this whole gravel thing a try… which leads to me to the mission I will be discussing today.

My intention with this piece is to share what I learned on my first solo bike packing trip, some of the adventure’s highs and lows, and hopefully capture the essence of what makes riding bikes so special.

Day 1: Overcoming Early Obstacles

Back in May a friend sent me a link to a route called, Miguel’s Olympic 360 Scramble, describing it as simply, EPIC. I took one look at it and felt my stomach drop. The route circumnavigated the Olympic Mountains. 418 miles, 30,000+ feet elevation gain, 50% gravel, 50% paved… with an estimated duration of 4-8 days. Sheesh.

The ride remained dormant in the back of my mind all summer. Sometimes making the time is adventure’s tightest bottleneck. Last month, I ran out of excuses. It was go-time.

Packing for a bike tour is a game of Tetris. Deciding which items are necessary and distributing weight laterally and front to back, I knew once I departed, I was on my own. Any challenges that arise would need to be solved on the spot.

I woke up the next day, finished packing, ate a hearty breakfast and was on the road by 7 AM. From my starting point in Mercer Island it was 22 miles to catch the 8:30 Edmonds -> Kingston Ferry. The trip was off to a good start, but using GPS to navigate was draining my phone battery quickly. By the time I stopped at Catkin Coffee in Quilcene (mile 43), both my external battery and phone were low on power. My ability to navigate, especially in a maze of gravel roads, was 100% dependent on my phone battery. Learning #1 was a simple one to solve. I picked up a cheap external battery from Walmart in Sequim, stopped blasting podcasts/music out loud and used low battery and airplane mode to conserve energy. This turned out to be a blessing. The silence allowed me to engage the present moment, think deeply and remain focused on the task at hand.

The second early lesson was a refresher that 1 mile does not equal 1 mile. At times, my average speed slowed to a walking pace as I pushed the bike up steeper sections, unable to ride on the loose gravel. What had I gotten myself into? Miguel advised 40-54mm tires, mine were 38mm. With longer gravel stretches ahead, I was nervous. My goal to finish in 5 days, 4 nights was already in question. But as the legendary coach, John Wooden said, “You never fail if you know in your heart that you did the best of which you are capable. I did my best. That is all I could do. Are you going to make mistakes? Of course. But it is not failure if you make the full effort.” Attitude and effort are the only two things you control on an adventure like this. I was ready to leave it all on the court.

West of Quilcene, I turned onto Penny Creek Road and started climbing. The pavement gave way to gravel and approached the eastern side of the Olympic Mountains. After a few miles, the route turned onto a road which apparently rarely sees car traffic. It was so overgrown that the only way forward was riding through bushes and leaves, barely able to make out the gravel road below. I also discovered that ascending and descending gravel, especially with the bike loaded for a multi-day trip, are two very different things. After cranking uphill you must recover and get focused for the descent. Similar to how a river runner picks a line through a rapid, I found myself “reading” the road, picking the smoothest, safest line possible.

Day 2: An Unforgettable Wildlife Experience

After 99 miles and 10 hours in the saddle day 1, I awoke to the sound of ocean waves and salty air at Dungeness Campground, feeling remarkably fresh. I continued west on the Olympic Discovery Trail, stopped for coffee and a breakfast burrito in Port Angeles, and began ascending the route’s first single track trail towards Lake Crescent.

I struggled a bit- a few times the rear bike bags jumped off the rack, which alerted me to the obvious velcro strap to prevent just that. Off the beaten path, exploring an area I had never seen before, this stretch was one of the highlights of the entire route.

Once I got in the rhythm, the only question was, how far could I go before sunset? Riding at night didn’t sound like much fun. The single track was enjoyable but the elevation gain made for very, very slow going. It was already getting late in the afternoon as I rounded Lake Crescent. I was up against the clock, pushing hard to reach my destination, Cycle Camp. 7 years ago, Bob, a free-spirited hippie opened up his property for the Olympic Peninsula’s two wheel travelers. Both bikes and motorcycles are welcome to camp, shower and even wash clothes, completely based on donations.

Besides the spectacular views and mechanically smooth day, the highlight of day 2 was one of the most intimate wildlife experiences I’ve ever had. The sun was low in the sky and I was deep in privately owned logging land when I came up on a herd of elk. About 50 yards ahead I could see 8 or 10 of them, and they could see me. My first instinct was caution. I tried to recall if I had ever heard of elk attacking people, which immediately sounded ridiculous. I spoke out loud to them, as though that might help. A moment later they got spooked and started running the other direction.

Assuming the show was over, I kept moving. The elk had not gone far. As the road steepened, I gained speed while the elk trampled through the forest next to me, creating what sounded like a violent wind storm or earthquake. Branches snapped, the ground churned and about 100 yards later, at the bend in the road, I came to a stop. Just 10 yards ahead, one after another, elk of all shapes and sizes ran across the road. There were easily 40 or 50 in the herd. I had goosebumps. I won’t get too ‘woo woo’ on you but it was as close to a spiritual experience as I’ve had. And to think I nearly opted for the highway to save time… I was buzzing with joy the rest of the evening.

Day 3: How Endurance Sports Separate the Mind and Body

Day 3 started with 20 miles of treacherous gravel. I slogged up the hills and white-knuckled my way down them. By the time I reached Highway 101, I was completely out of food. With no services in the next 75+ miles I decided to take the 101 through Queets. This was the only section where I didn’t follow Miguel through the mountains. I was a bit frustrated with myself for not preparing thoroughly when I noticed a blue and yellow farm stand with fresh blueberries for sale. 2 pints for 5 dollars… I packed one and devoured the other.

Riding solo 8-10 hours a day, I had plenty of time to think. Mostly about bitcoin but other things too. It was more than just the stark contrast between a typical “busy” day in the city vs. the simplicity of riding a bike. I was pushing myself mentally and physically harder than I ever had in my life. I had laser eyes. It might sound crazy but my mind and body became two separate entities. Like a player and coach, my mind and body worked together. I rested and re-filled water at streams, made instant coffee and gobbled up carbs all day long. Dusk came, and I made camp somewhere along a forest service road west of Lake Quinalt. 140 miles remained.

Day 4: A Nearly Derailed Mission

The two highest points on the route were just ahead to start day 4. That also meant the fastest, steepest descents. My body was sore, but mentally I was ready for another strong push. My bike had other plans. Out of nowhere, the rear (E-Tap) derailleur stopped shifting, stuck in the lowest (hardest) gear. For the next 15 miles I walked the steep uphill sections and coasted downhill, but I wasn’t going to be able to be able to finish the ride without a functional rear derailleur.

Stressed, I stopped at the Quinalt Library to connect to Wi-Fi. After a few internet searches I concluded the bike must have gone into “crash mode.” I figured the gravel descent was so intense the electronic shifting components assumed the bike had crashed. With that problem solved, the stoke was back.

It was beautiful, but damn it was hot. The tradeoff with riding clear-cut logging land is more scenery, but less shade. I passed a logging crew and one of the guys jokingly said, “I didn’t think I was going to have to flag traffic out here!” Pondering the dynamics of the timber industry, I marveled at how just a few men with big machines could impact the landscape so dramatically. I thought about how humans rely on wood, previous generations settling in Washington with the sole purpose of logging, and the fact that the road I was on wouldn’t exist if a private timber company didn’t build it.

By evening, I had entered the pain cave. My back and neck were sore, my left wrist was acting up, and my seat bones were swollen… but mainly my knee was killing me. It’s a pain I’m quite familiar with and have been able to manage through eating a clean, animal-based diet and more intentional mobility training. To me, pain triggers fear about more pain, and less of what I love. But pain is part of the game. I spent nearly 11 hours in the saddle day 4 and still came up short of the nearest established campground. I even sang along to some Eminem throwbacks to rile me up during the final climb of the day.

In another situation I would have been worried about where I was going to camp, but by this point, with the laser eyes, I didn’t care. I pitched my tent, looked up and realized I was directly in front of private property/no trespassing signs. Whoops. I figured, at least my tent is green and matches the bushes. Cars won’t even notice me. I dozed off to the sound of harbor seals and waves crashing on the rocky beach beside me.

Day 5: A Renewed Appreciation for My Home State

One of the recurring thoughts I had throughout the trip was just how grateful I am to call Washington home. I spent 4 days in awe of places I had driven past dozens of times, but never explored. Fresh air, clean water, fantastic summer weather and virtually limitless possibilities for recreation… what else do you need to call it paradise? A renewed sense of appreciation for Washington was the biggest thing I took home with me, and it didn’t take up any space in my bags.

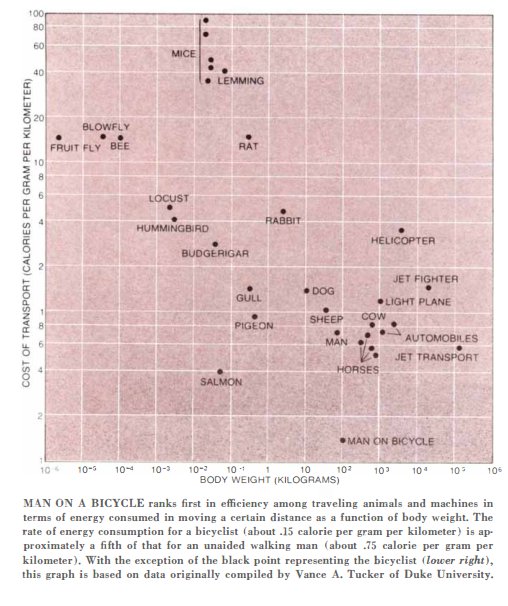

Another major realization I had was just how efficient it is to travel by bike. Not only is it “greener” than driving, it’s also cheaper, since you won’t be paying for gas, campsites, parking and speeding tickets. In 1973, S.S. Wilson wanted to prove that migratory birds were the “masters of efficiency- which turned out not to be the case.” He used data compiled by Vance A. Tucker of Duke University (see chart below) to compare various animals and forms of transportation, with Body Weight (Kilograms) on the X-axis and Cost of Transportation (Calories per Gram per Kilometer) on the Y axis. In fact, a man on a bicycle is more efficient than another animal on earth, as well as cars and planes. There’s a fun fact to share on your next group ride 🙂

The route ends with a proper homecoming, approaching the Seattle waterfront by ferry. Surrounded by summer tourists, I felt a sense of accomplishment. I’ve sent some pretty ridiculous missions in the past, but this one felt different. Nobody knows what I just went through. For all they know I just came across the sound for a cup of coffee. But in fact, I had just completed the hardest endurance mission of my life.

When I got home I sent a photo with a thank you note to my friend, James, who sold me the bike. He responded by saying, “So cool, you’re going to have tons of amazing adventures! The bike will set you free…” That’s it. The bike will set you free.

Freedom is not a short-term rush like the adrenaline kick from hitting a jump on a mountain bike. The human spirit yearns to be free. Unfortunately, freedom is not the norm. Not today, and not at any point in recorded history. There are more entities trying to limit your freedom and control your attention than ever before. You didn’t ask for my advice, but if something makes you feel free, do more of that thing. Doing what you love is an act of rebellion.

The same reason I fell in love with bikes as a kid is why I love riding today. Aside from giving you a few tips for when you go ride Miguel’s Olympic 360 Scramble, I hope this inspires you to think about what sets you free, and do more of that.

Thank you,

Kyle ❤